Non-purpose loans

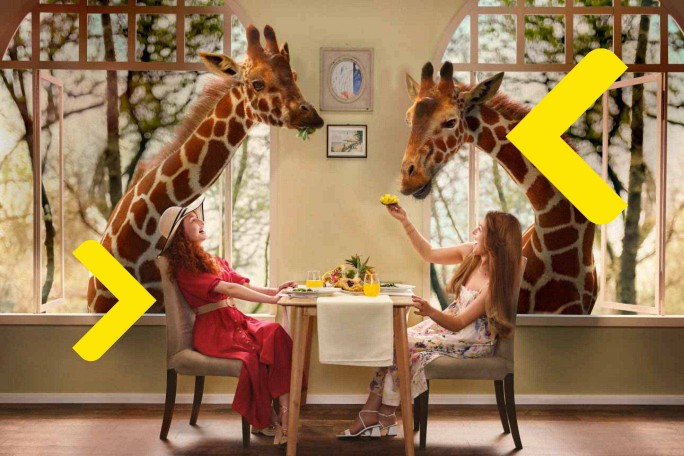

Make the trip of a lifetime possible!

Non-purpose loans

Turn your wish list into reality right now with a non-purpose loan from Raiffeisen Bank.

No management fee

for Cash and Integral loans when applying online

Security instruments

Salary pledge, standing order, promissory note(s), loan insurance; alternatively, a co-debtor

Repayment periods up to 10 years

No fee for managing the credit account.

Make room for the greatest joy possible

Apply online for a non-purpose loan and decorate the children's room right now.

Apply online for your loan now

Frequently Asked Questions

Here you can find answers to the most frequently asked questions.

An annuity represents an equal monetary amount used to repay the loan during the period of the same interest rate. Each monthly annuity consists of interest and principal, and the ratio of the interest and principal amounts in the annuity changes during the loan repayment period. Initially, the interest portion of the annuity is higher compared to the principal, but over time, the principal portion of the annuity becomes larger compared to the interest. The due date of the annuity is defined by the individual repayment plan for the respective loan.

A fixed interest rate is an interest rate that does not change during the loan repayment period. A variable interest rate changes during the agreed period. It consists of a variable element of the interest rate and a fixed element of the interest rate. The variable element of the interest rate is determined based on the reference rate: the 6-month EURIBOR. The bank applies two reference periods: 01/01-06/30 and 07/01-12/31, and the determination of the reference rate value as part of the variable element of the interest rate is done twice a year, on the last working day of the current reference period.

The regular (nominal) interest rate is the interest that the Bank calculates during the loan repayment/grace period. It is calculated on the outstanding principal of the loan and is paid in accounting periods according to the repayment plan. The nominal interest rate is defined by the loan agreement. The effective interest rate (APR) is the interest rate that reflects the total cost of the loan. The APR is influenced not only by the regular interest rate but also by the amount of fees and all other costs that the client pays when the loan is approved, the loan repayment term, the amount of any required deposit, etc.

A currency clause in dealings with a bank is most commonly associated with loans. It is a security instrument for the bank that protects it from the devaluation of the domestic currency. Practically, it means that the loan provided by the bank is tied to the value of a foreign currency.

EURIBOR (Euro Interbank Offered Rate) is an interbank reference interest rate determined in the European interbank market. The bank cannot influence the level of EURIBOR and cannot predict its future movements.